Rewards and risks: Investments for retirement income

Almost all investments come with their own risks and rewards.

Ideally, your investments should offer you a substantial return so that you can continue with your current lifestyle without dedicating too much time or energy managing your money.

Let's discuss the 4 most common investments options along with the risks and rewards associated with each.

1. High interest savings account

This is probably the most common investment options that almost everyone has heard about and associates a lower -risk with.

Rewards:

It basically involves setting aside a desired amount of your liquid assets in a separate account (savings account) and have the banks pay your interest. You can withdraw the money from your savings accounts if you want to, but you might have to pay a withdrawal fee.

Ideally, you should open a savings account at a bank that offers the best interest rates for your deposit.

When choosing a bank, you could consider many options including a good reputation for customer service, online access and easy deposits to name a few. Consumer NZ regularly conducts banking satisfaction surveys which could be worth a look.

Risks:

The returns are traditionally fairly low as compared to other investment options. This can be seen as a risk if your goal is to grow your

money fast so is dependent on what you want to achieve.

2. Annuities

Annuities are usually offered by an insurance company.

Rewards:

This is how it works - you invest your savings, usually a large sum, to receive a guaranteed income for a long period of time; usually, for the rest of your life.

Your savings are invested in a balanced fund which is similar to a KiwiSaver fund. A lot of retirees get attracted to annuities because they offer steady payments. Your earnings will be directly deposited into your nominated bank account.

Risks:

Deciding to invest all your life savings into an annuity is an irreversible decision. Which means if you find better investment options in the future, your hands will be tied as you probably wouldn't have substantial amount of money to invest somewhere.

Annuities aren't inflation proof. Maybe an earning of $2500 / month from your annuity is sufficient for now. But years later, if prices rise, you might end up struggling to get by because you're still earning $2500 only.

3. Shares

You guessed it right - as the name suggest, buying 'shares' involves buying a small portion of a company of your choice.

Shares are bought through a share broker but it could be prudent to do your personal research on a company before you invest any money in buying their shares.

Rewards:

Dividends

In simple terms, a dividend is the sum of money which is paid by the company to it's shareholders when it makes a profit. As a buyer, you can either choose to take this money or reinvest it to buy some more shares.

Capital gains

You're probably familiar with the idea of buying something at a lower price and selling it for a higher price. This can be done with shares as well.

You can buy shares at a lower price, and as time passes, you can sell them for a higher price to make profit - if only the financial value of your shares increase, which takes us to the risks of shares.

Risks:

Shares prices can be extremely volatile and neither your share broker nor the company can predict accurately whether their share prices will fall or rise. There are some factors that affect a share's price which are beyond anybody's control, for example social and political unrest, natural disaster, supply and demand etc.

We talked about capital gain earlier, now, let's talk about capital loss. You might buy shares for a given price, hoping their value will increase with time and you'll make profit by selling them at a higher price. However, if their value doesn't increase, which is certainly possible, you might end up incurring a loss.

(Read more : New Zealand investors need to do their research )

4. Peer-to-peer lending

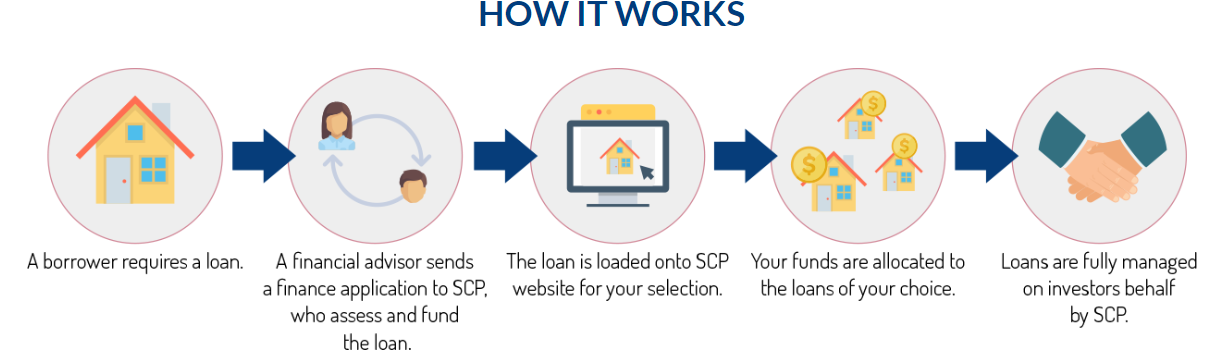

Peer-to-peer lending involves an online service that matches lenders with borrowers who need to borrow money for a variety of reasons.

Rewards:

From a lender's perspective, you have the opportunity to lend your money to the borrowers who need to raise funds against property.

You'll have no contact with the borrower, as the peer-to-peer manager will take care of it. However, you'll enjoy a registered first mortgage security over their property

Now the next question on your mind might be, "What's the rate of return?"

Well, it depends on the P2P lending platform, for example, here at Southern Cross Partners, investment interest rates start from 6.25 – 8.00%* p.a which is paid monthly.

You can easily open an online account and even invest in a portfolio of many loans at once if you want to.

Risks:

In an event where the borrower defaults, the lender might risk losing their investment. But we handle this risk proactively by doing credit checks, assessing buyer's affordability, and last but not least - securing the loan with a first registered mortgage over property, which can be sold.

Want to calculate how much you can earn with P2P lending?

.jpeg)