When someone comes to us with an 'outside of the status quo' borrowing problem, typically there are two reactions from brokers:

- Option 1: We're quick to see the application as 'too hard basket' and say no to our potential client.

- Option 2: We say yes and connect the client with a short-term lending solution like Southern Cross Partners and leave them to their own devices

What a lot of brokers don't realise, is that there's a third option that actually ends up in you, the broker, being paid twice for the same client:

- Option 3: Getting your borrower in shape with Southern Cross Partners then back to the bank in 12 months, earning two commissions for doing the right thing for your client.

In this blog, we'll detail how as a broker, you can essentially get paid for the same client twice through the nurturing and retention process.

Step One: Understand the Big Picture Goals of Your Client

The first step to helping a client through their borrowing journey (and ultimately, doubling your payment) is to understand the big picture around their long-term goals.

The reasons why your client might be turned down by the bank range anywhere from credit issues in the past, unforeseen circumstances such as a divorce causing personal finance problems or simply the banks' reluctance to finance for higher LVR investment properties.

Whatever the reason for the bank declining the loan, in a nutshell, the client is coming to you for help in a time of need.

They're looking to you, the broker, to do your best to find a solution that will work for them in the short term, and help them to get back in a healthy financial position and eventually back to the bank for a long term loan solution.

Step Two: Get Paid by the Client for the Short-Term Solution

There are two things we know about clients who seek help from a broker when they're turned down by a bank for a traditional loan.

1. Most borrowers don't know an alternative solution to the bank

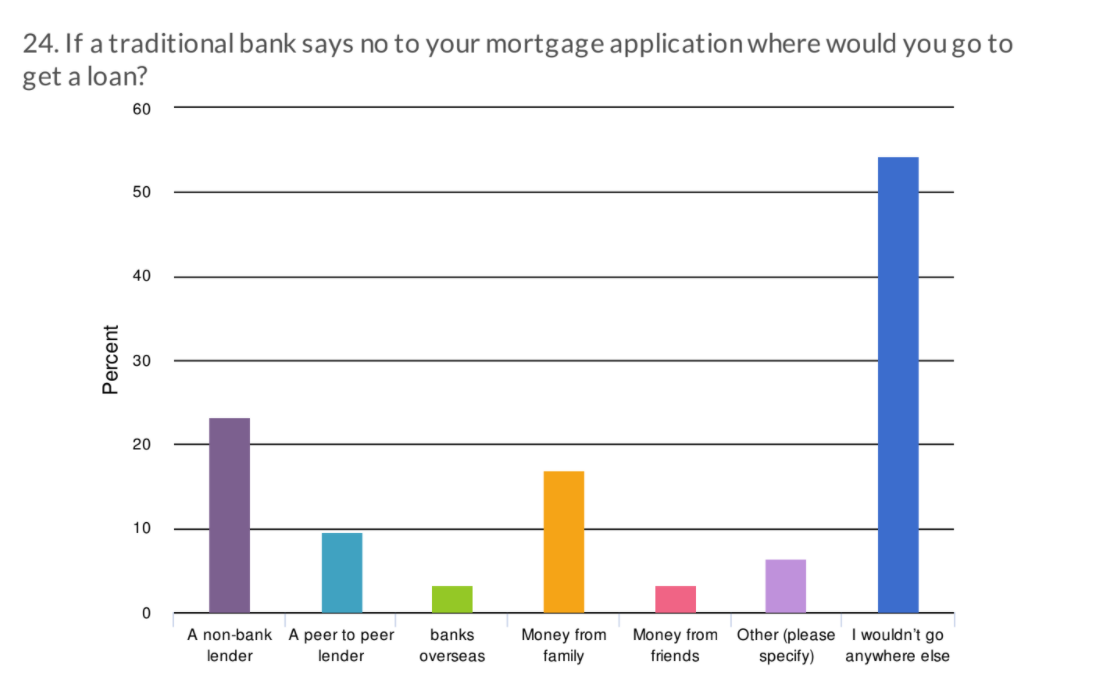

In a recent survey we conducted at Southern Cross Partners, it was found that when asked; "if a traditional bank says no to your mortgage application, where would you go to get a loan?", 54.4% of all respondents said that they wouldn't go anywhere else.

That means for over half of loan applicants, their borrowing process wouldn't go any further than a bank, expressing just how in demand the services that a broker offers actually are.

2. Borrowers see brokers as extremely valuable and in a positive light

Borrowers who are in a predicament and looking for a short-term solution know that brokers are the gatekeepers to the 'yes' they're after.

In the same survey, when asked "thinking of mortgage brokers, what statements do you agree with?", the top statements painted a picture of trust and thought leadership.

- Brokers take the hassle out of getting a mortgage (36.8%)

- Brokers go to multiple organisations to get the best deals (34.4%)

- People who use brokers get betters deals on mortgages (25.6%)

- Brokers know more about finance than me (32.8%)

What does that mean for me, the broker, and how do I get paid?

Essentially, 92% of people are more than happy to pay you for your expertise.

By pairing your client with a short term lending solution like Southern Cross Partners, you're delivering the solution that the client needs and being paid commission for your help.

Your client wants to get from point 'A' to point 'B', and you're getting paid to guide them through the journey via a non-bank lender. That's payment number one.

Step Three: Get Paid by the Banks for the Long-Term Solution

As we mentioned, pairing a borrower with a non-bank lender is only a part of the journey, and the big picture goal is to guide your client through until their in a financial place where they're able to go back to the bank and be approved.

Some brokers treat the job as 'done' once they've matched the borrower with the non-bank lender.

From the perspective of the broker, that's actually money lost. If you're able to nurture and guide your client all the way through their non-bank loan repayments and keep them on track up until they're ready to move into a traditional bank loan - not only will your client be thrilled with the outcome, but you'll be ready to connect them with the bank.

This is where the broker gets paid twice at no expense to the client. Typically, banks will pay brokers a commission for sending through a successful loan application.

Step Four: Nurture the Relationship into a Client for Life

If you're able to help your client all the way through the process and successfully achieve their exit strategy, chances are you'll have developed a strong relationship with your client.

We've had many brokers work with clients through this process who are so satisfied that come back to the same broker for new loans time and time again, and even recommend the same broker to their children or family members years later.

Putting in that extra work to see each client through not only makes for a satisfied client and a double-payed broker, but forges a lifelong relationship that keeps giving to both parties.

If you'd like to find out how Southern Cross Partners can help you to find effective solutions for your more challenging clients, please get in touch below.