Investors - What would you do during a recession?

Recession - the word itself can cause panic among the masses. With a recession comes unemployment, loss of jobs, bankruptcy - not to mention a whole lot of stress and constant anxiety.

A recession can last for up to 6 months, and could have a lasting effect if you don't plan your finances wisely. Now the question is, does a recession-proof investment strategy exist? Let's find out.

What is a recession exactly?

There are a few definitions for recession but, in short, economists define it as "a period of temporary economic decline during which trade and industrial activity are

reduced, generally identified by two consecutive quarters of negative gross domestic product (GDP) growth."

There are several factors that could lead to a recession:

- High-interest rates: When the interest rates are high, it makes it difficult for people to liquidate their money and, as a result of this, there's less money to invest.

- Inflation: Inflation is an event in which the prices of goods and services rise. When prices rise, the percentage of goods/services that can be purchased with the same amount of money (before inflation) decreases.

- Lower consumer confidence: If consumers lose faith in the economy, they're more likely to be defensive and save their money instead of spending it.

What happened in New Zealand in the last recession?

The 2007/08 Global Financial Crisis (GFC) devastated the global economy leading to hundreds of billions of dollars of bailouts and the introduction of quantitative easing in the US.New Zealand’s economy was badly damaged as a result of the GFC, with unemployment jumping from below 4% to 6.5% in the space of just a year.

The New Zealand Treasury said that New Zealand's real GDP fell 3.3% between the December 2007 quarter and the March 2008 quarter, and that this start, before any other OECD nation, was the result of domestic factors. It said that New Zealand's recession was among the first to finish, lasting 18 months, and was one of the shallowest.

But of course most investors remain acutely aware of the substantial number of finance company collapses between 2006 and 2012 as well as the housing stats in New Zealand that fell 20 percent in June 2008, the lowest levels since 1986.

Where could you put your money during a recession?

It's understandable that many investors would be alert and defensive during a recession and might become a risk-averse investor who avoids high-risk investment options and sticks to their comfort zone - of which, there are pros and cons.Yes, they could avoid losing money but, at the same time, they will miss on having great returns. Risk-averse investors usually go for investment options like savings accounts, bonds, immediate annuities or dividend growth stocks, as these options are widely considered as low-risk.

How might peer-to-peer lending do during a recession?

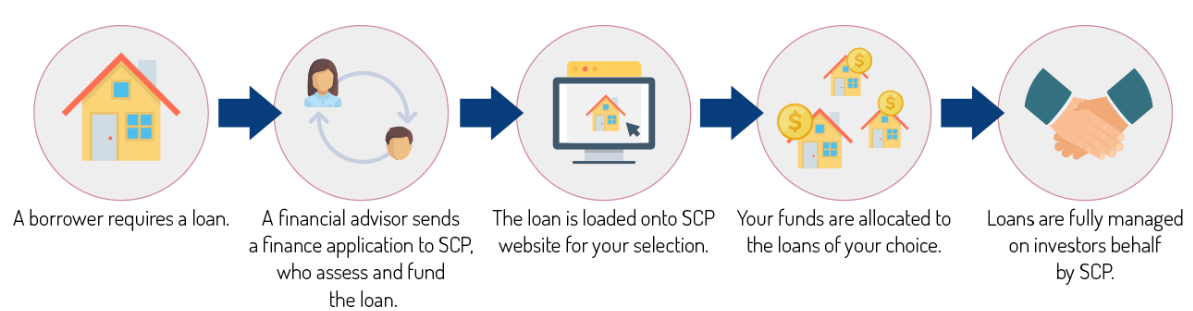

Let's just quickly reiterate what peer-to-peer lending is. It involves people who want to borrow money and the ones who want to lend money. The transaction is managed by a third party, also known as a peer-to-peer lending platform, like Southern Cross Partners.

We offer people a chance to invest in short-term mortgages with current interest returns of 6.25% to 8% per annum - paid out monthly.

Here's what you could expect from P2P during a recession:

1. Loan defaults

Loan defaults are highly likely during a recession. If the borrower defaults, the lender risks losing their investment.

But there are certain platforms that mitigate this risk by doing credit checks, assessing the borrower’s affordability, lending the appropriate loan to value ratio (LVR) and securing loans with a first registered mortgage over the right property that can be sold to recoup the investment- Southern Cross Partners being one of them.

It might be difficult to sell the property during a recession so, as mentioned above, lending to the right level on the right property could make a difference to recouping an investment while waiting for the economic situation to come back to normal.

2. The ability to have a diverse portfolio

As one of the greatest investors of all time, Warren Buffet, said, "never test the depth of a river with both feet." An intelligent investor knows the value of having a diverse investment portfolio in order to mitigate the inevitable risk that comes with every type of investment.

How does diversification spread risk in P2P lending? Well, it enables you to invest in a portfolio of many loans at once using a list of loans that are immediately available; which means you don't have to put all your eggs in one basket.

3. Monthly payments

It can help if you have a steady source of income during a temporary economic downturn like a recession The interest from your peer-to-peer lending investments,

on the Southern Cross Partners platform for example, is paid to you on a monthly basis. You don't have any contact with the borrower and the company will manage outstanding payments - this also includes taking necessary actions to recover money from the borrower.

While a recession might not be imminent, it pays to make sure you're prepared. If you want to know more about how peer to peer investing could work for you, we're always here to help. Get in touch with the team today!

.png)