The What, How And Why of Peer-to-Peer Lending

As you move closer to retirement or if you have retired already, one of the biggest challenges for you is to have your investment generate a reasonable and reliable source of income.

You already know there are plenty of investment options out there - stocks, bonds, rental real estate and the list goes on.But which one is the best for you? Oh, the paradox of choice - having so many options makes it even more difficult to choose one, doesn’t it?

Fact is, every investment comes with its own set of pros and cons, and there’s nothing wrong with it - because that’s how it’s supposed to be.

Some investments give you a good return but only after a fixed term; others give you a regular revenue - but not at a great rate.

But what about peer-to-peer lending?

As an alternative investment option, is it something worth considering?

To understand this better, let’s jump into the What, How and Why of peer-to-peer lending.

What is Peer-to-Peer Lending?

Peer-to-peer lending means that borrowing and lending occurs between everyday people; pretty handy, right?

Now, you might think, “if banks are not involved, is all this stuff regulated?”

And the answer to that question is a resounding yes!

However there is a third party involved that mediates between the borrowers and the lenders. It’s called a peer-to-peer lending platform, like Southern Cross Partners.

You probably didn’t know this yet, but since 2014, peer-to-peer lending services are required to be licensed after relevant changes were made in the Financial Markets Conduct Act 2013.

Check out our free calculator to see how much your investment could return to you as a regular income.

How does peer-to-peer lending work?

Well, it’s not really that complicated.

As a peer-to-peer lending platform, we offer people a chance to invest in short-term mortgages with current interest returns of 6.25% to 8% per annum - paid out monthly.

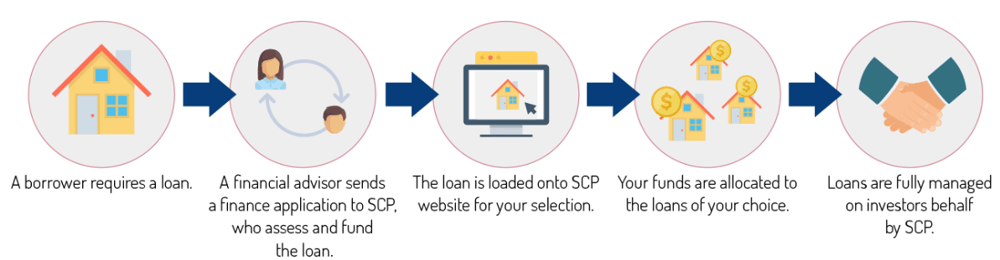

Let’s understand how this works step-by-step.

Step 1: Property owners and purchasers come to us looking for a non-bank short-term loan.

Step 2: After the loans are checked by our credit teams, we at Southern Cross Partners use our own funds to provide these loans to the borrowers.

Step 3: Now it’s your turn. We offer investors like you a chance to take on all (or part) of these loans. The decision is yours to make.

Step 4: After you have invested, we will continue to manage the loans on your behalf, collect interest payments and pay them out to you.

Even though you won't have any contact with the borrower, you will enjoy a registered first mortgage security, held in trust, over the buyer’s property.

“Who is responsible if the borrower doesn’t pay the money back?”

It’s worth repeating: you won’t have any contact with the borrower and we are committed to taking the necessary action for recovering payments.

Why should you consider peer-to-peer lending?

Did you know, unlike most other investment options, your peer-to-peer investment will be supported by a first mortgage registered against a piece of Real Estate?

Not only this, but you can also select the location and the loan-to-value ratio that best suits your investment risk profile and investment strategy.

However all investments have risks so please ensure you fully understand the investment opportunity and any associated risks.

Some other benefits of peer-to-peer lending are as follows:

You have the flexibility to invest in many loans at once.

Rest assured, we will you give all the necessary information that will make it easy for you to choose where to invest your money.

Invest in one loan or spread it over several, the choice is yours

Alternatively, your trusted financial adviser can help you with choosing your peer-to-peer investments.

You can receive monthly payments.

We will collect all interest payments from the borrower, ensuring that these are held in a separate trust account, and, once received, will then pay your interest to you each month.

All investments are supported by first mortgage security.

All mortgages are provided to our Trust Company – Loan Investment Trustees Limited – with these mortgages held on behalf of each and every investor in those particular loans. This means that should a borrower not be able to repay their loan we are able to take the appropriate recovery action.

Still unsure of the best investment option for your retirement?

Download our Guide to Retirement now. It's free.