Top tips for keeping your personal information safe in the portal and online

With the introduction of our new investor portal, we thought it would be a perfect time to remind you of some simple ways to ensure you’re keeping your information safe online.

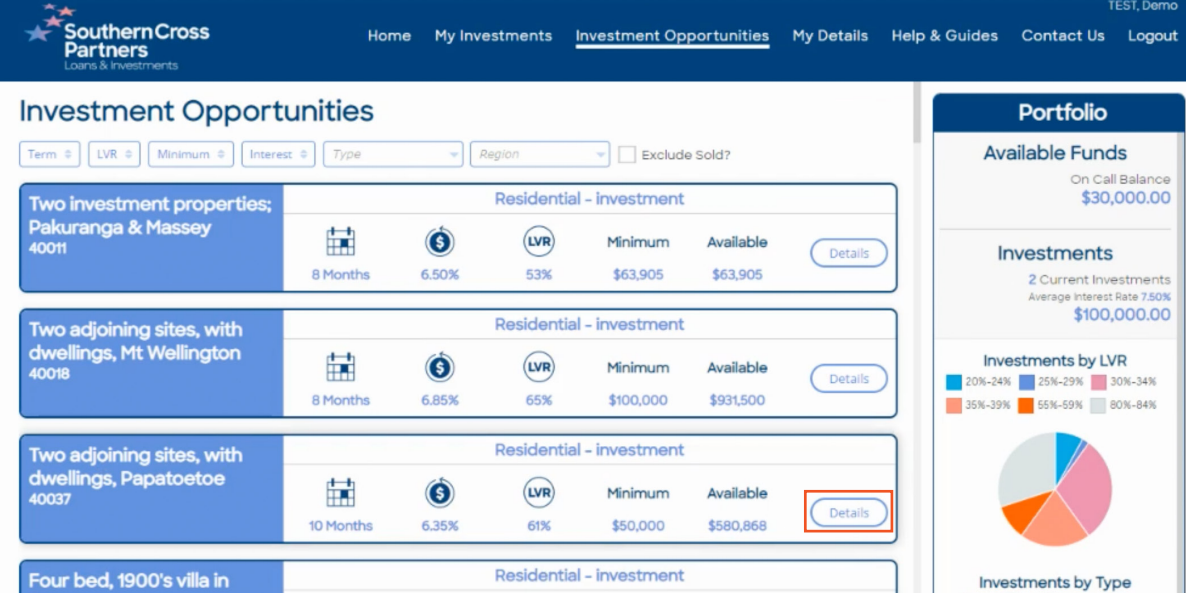

We have multiple security measures in place to protect the data we have on our investor portal. While we don’t store your bank account details or date of birth in the portal, your IRD number and contact details are housed in the portal.

Therefore, it’s important that you do what you keep your password safe so other people can’t use it to access the portal.

Below are a few handy tips to help you keep your information safe online:

- Make sure your password is strong

Many people think a secure password needs to be a random string of letters and symbols in order to be difficult to crack. However, using a passphrase that create an easily remembered sentence is just as effective, and easier for you to both type and remember.

A passphrase can be a series of words that are familiar to you or easy, and can include uppercase and lowercase letters, as well as symbols and numbers wherever you like. Think about song lyrics, food you like, or objects around you to make up phrases you can recall.

- Use unique passwords

No matter how complex your password is, it’s useless if you’ve used it across multiple accounts. If one of your accounts has been compromised and you use the same password and login email across different websites, a hacker can easily reuse credentials to log in and steal your data. That’s why it’s imperative you never use the same password twice, especially across business and personal accounts.

- Never, ever give your password away

Don’t give your passwords to anyone else and never write your password down on a sticky note attached to your computer. If you get an email from a colleague, administrator, or bank asking for your password, don’t take it at face value – pick up the phone and call that person if you have doubts.

- Stay vigilant when checking emails or text messages

Get into the habit of reading and analysing emails and who sent them before responding. Have a healthy amount of scepticism for any email that seems a little unusual. Do you know and trust the sender? Is this the type of communication you’d expect from the sender, or is there something unusual about the request? If there is and doubt, report the email as spam.

- Always check before clicking on any links

Do not click on any links, attachment downloads, or respond to any requests for information if you’re not sure of the sender. If something seems fishy, it probably is. Again, report the email as spam and remove it from your inbox.

Southern Cross Partners will never ask for your personal information without prior warning. Always check to ensure the sender email ends with @scpartners.co.nz to be sure the email is from us.

If you do think there’s anything wrong with information we’ve sent on email or in the portal, you can always touch base with the friendly investor team on investments@scpartners.co.nz.